The Secured Overnight Financing Rate—widely known as SOFR—has become the leading benchmark interest rate in the United States, replacing LIBOR and serving as the foundation for pricing trillions of dollars in financial contracts. Built on deep, transparent market data, SOFR offers a reliable reflection of short-term borrowing costs in the U.S. financial system. For lenders, investors, and borrowers, understanding how SOFR works is crucial for navigating today’s interest-rate environment.

What Is SOFR?

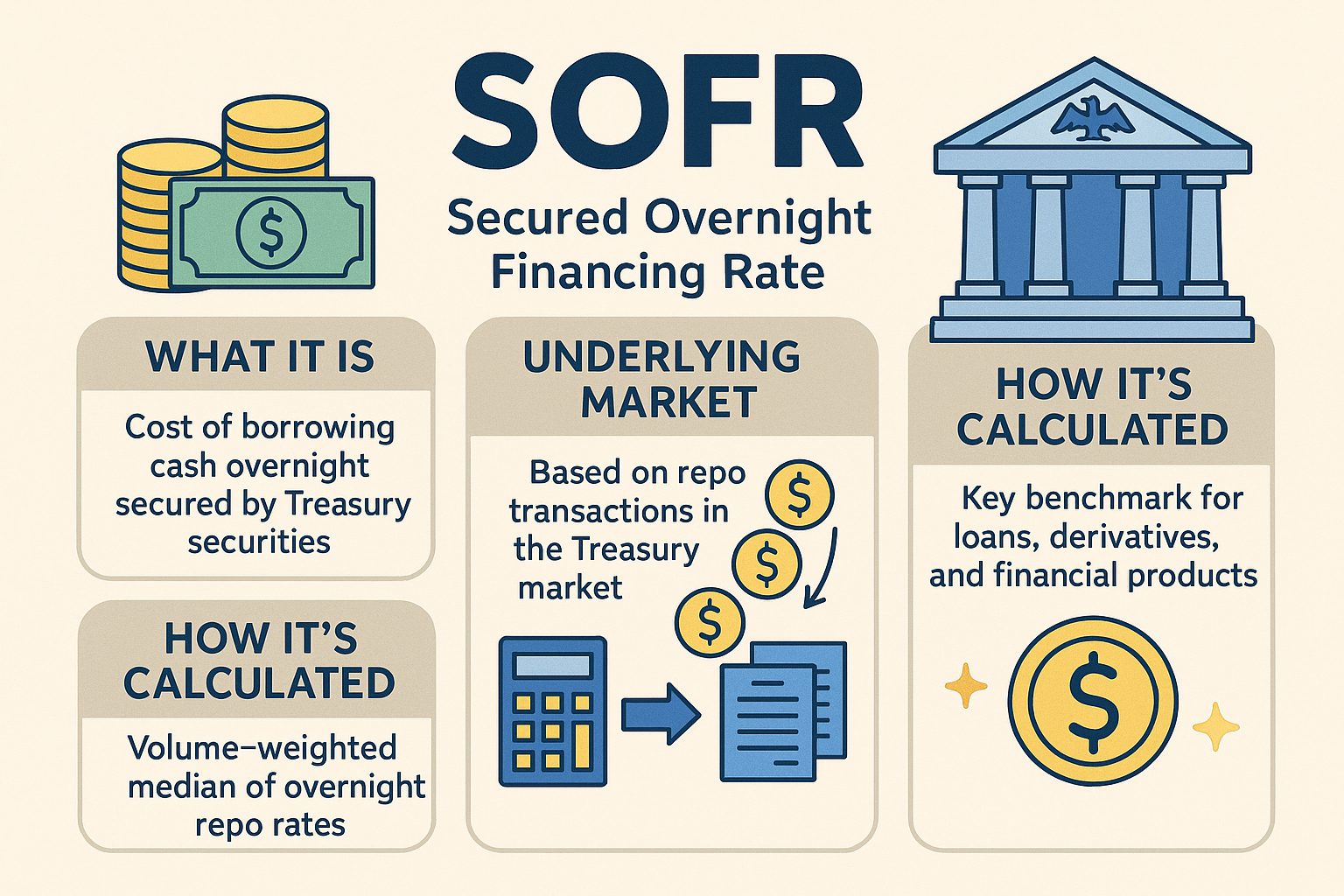

SOFR represents the cost of borrowing cash overnight using U.S. Treasury securities as collateral. Because these loans are backed by the safest assets in the world, SOFR reflects minimal credit risk and provides a stable, market-driven benchmark for the short-term funding environment.

Where SOFR Comes From: The Underlying Market

SOFR is derived from the U.S. Treasury repurchase agreement (repo) market, one of the largest and most liquid funding markets globally. In a repo transaction, one party sells Treasury securities and agrees to repurchase them the next day at a slightly higher price. The Federal Reserve aggregates repo data across several major segments, including:

- Tri-party repo market

• General Collateral Finance (GCF) repo

• Bilateral repo transactions cleared through FICC

How SOFR Is Calculated

SOFR is calculated using a volume-weighted median of all eligible overnight repo transactions from the prior business day. This method keeps the benchmark stable, prevents outlier trades from skewing results, and ensures SOFR reflects true funding conditions.

Why SOFR Matters

SOFR is now the primary benchmark for adjustable-rate loans, commercial financing, corporate borrowing, and derivatives. Because the rate is transparent, transaction-based, and backed by deep market activity, it offers significantly more reliability and stability than the former LIBOR benchmark.

SOFR Variants Used in Lending

Although SOFR is an overnight rate, market participants use several adapted forms, including:

• Term SOFR (1-, 3-, 6-, and 12-month)

• Compounded SOFR in arrears

• 30-, 90-, and 180-day SOFR averages

These variants allow SOFR to behave similarly to LIBOR by providing forward-looking or averaged rates suitable for loan and derivative contracts.

In Summary

SOFR is a critical part of the modern financial system, offering a transparent, data-driven benchmark rooted in real Treasury-backed lending activity. Its adoption promotes market stability and supports more consistent, trustworthy pricing across financial products.