The Federal Home Loan Bank (FHLB) System is a crucial—yet often overlooked—pillar of the U.S. financial system. Created during the Great Depression to stabilize mortgage lending, FHLBs today provide liquidity, support housing finance, and strengthen the broader economy. This article breaks down how the system works, what regulations govern it, how banks use it, and why it matters to the overall financial markets.

What Is the Federal Home Loan Bank (FHLB) System?

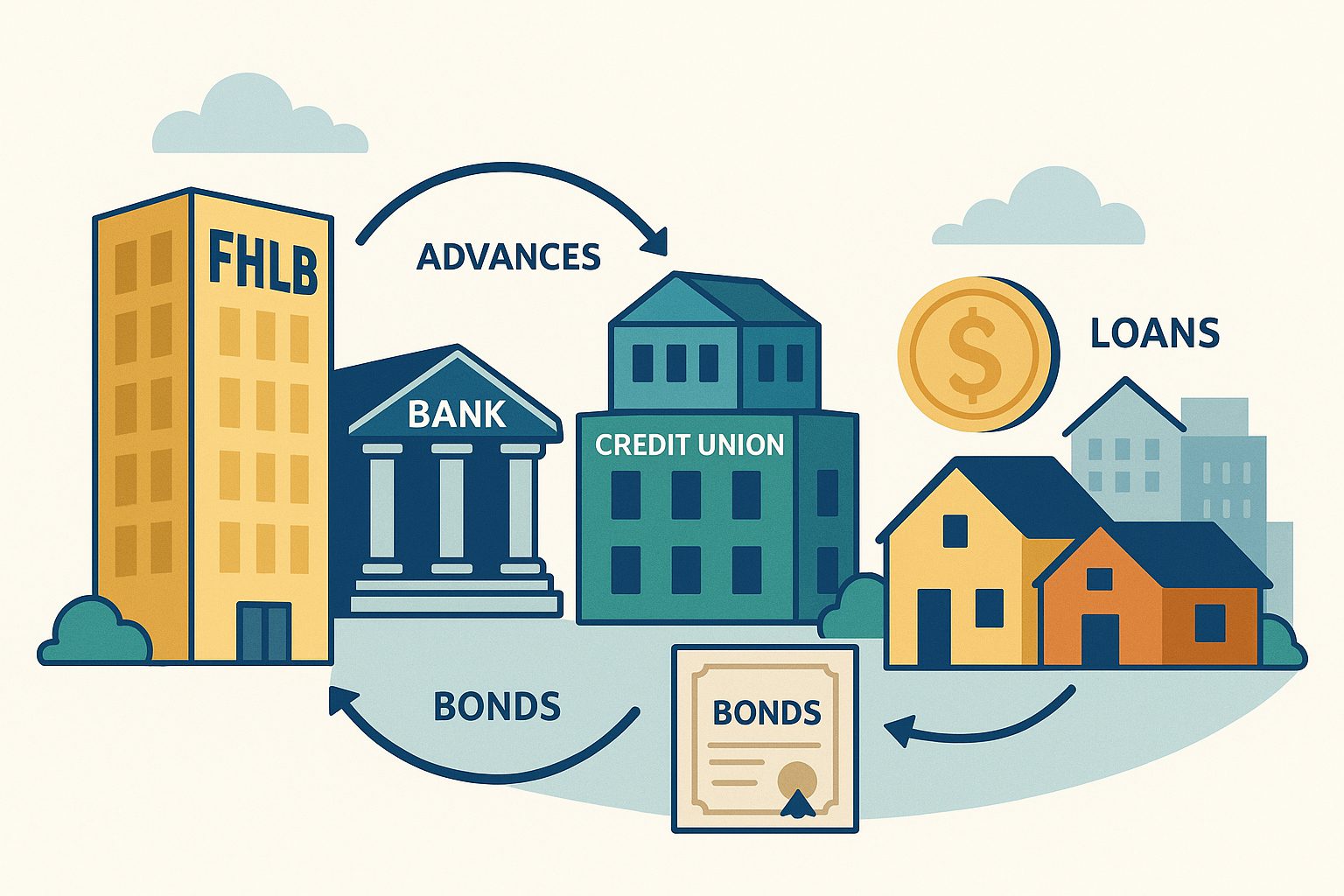

The FHLB System is a government‑sponsored enterprise (GSE) composed of 11 regional banks. These banks are cooperatively owned by member institutions such as banks, credit unions, insurance companies, and community development financial institutions (CDFIs). Its mission: support housing finance, provide liquidity, and promote financial stability. FHLBs do not lend directly to consumers; instead, they support the lenders who provide housing and community credit.

How the FHLB System Works

FHLBs lend to members through secured loans called “advances.” These advances are collateralized by mortgages, securities, and other eligible assets. Because advances are over‑collateralized and tightly regulated, they are among the safest forms of institutional borrowing.

Members can draw short‑term or long‑term advances to fund mortgage pipelines, manage liquidity, or hedge interest‑rate risk. FHLBs fund these loans by issuing highly rated debt instruments—discount notes and bonds—widely used by global investors.

Regulations Surrounding the FHLB System

The Federal Housing Finance Agency (FHFA) regulates the system. Key areas include membership requirements, collateral rules, capital standards, stress testing, and affordable housing contributions.

FHLBs also fund Affordable Housing Program (AHP) grants, Community Investment Program (CIP) loans, and other community development initiatives required by law. Annual examinations ensure safety, soundness, and risk management.

How Banks Use FHLB as a Benchmark

Banks often benchmark FHLB advance rates against alternative funding sources because FHLB debt trades just above U.S. Treasuries. This makes it a valuable reference curve for pricing:

- Deposits

- Wholesale funding

- Mortgage rates

- Balance‑sheet strategies

Banks also use advances to stabilize interest‑rate exposure and match asset‑liability durations.

How FHLB Supports Financial Markets

The FHLB System supports the financial markets by:

- Providing liquidity during periods of stress

- Supporting mortgage availability nationwide

- Issuing high‑quality debt securities used globally

- Reducing systemic risk by supporting small and large institutions alike

FHLBs often act as a liquidity backstop—providing funding well before institutions ever turn to the Federal Reserve.

Conclusion

The FHLB System is one of the most important financial stabilizers in the United States. By supporting liquidity, strengthening housing finance, and providing high‑quality investments to global markets, it plays a major role in maintaining economic stability. Understanding how the FHLB works and why banks rely on it helps clarify why this system remains essential to the nation’s financial infrastructure.